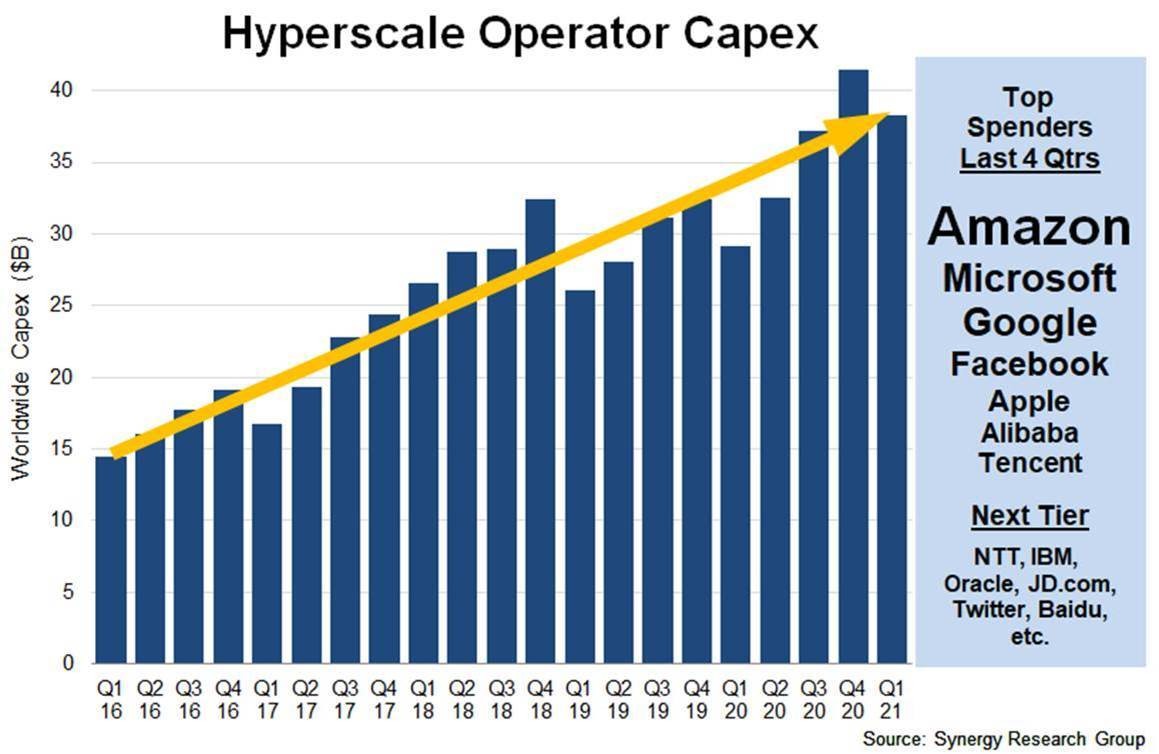

That brings the total for the last four quarters up to over $149 billion, compared to $121 billion in the previous four quarters. The top four hyperscale spenders in the last four quarters were Amazon, Microsoft, Google and Facebook, whose capex budgets far exceeded the other hyperscale operators. After this group the next biggest spenders are Apple, Alibaba and Tencent. Among the largest hyperscalers, capex growth at Amazon and Microsoft was particularly strong, while Google spending dropped off a little and Apple’s capex bounced back a bit in the last two quarters. Facebook, Alibaba and Tencent all continue to ramp up their spending. Outside of the top seven, other leading hyperscale spenders include IBM, NTT, Oracle, JD.com, Twitter and Baidu.

Much of the hyperscale capex goes towards building, expanding and equipping huge data centers, which grew in number to 625 at the end of Q1. The data center share of capex varies greatly quarter by quarter and from one operator to another, but on average data center spending accounts for well over half of all hyperscale operator capex. The hyperscale data is based on analysis of the capex and data center footprint of 20 of the world’s major cloud and internet service firms, including the largest operators in IaaS, PaaS, SaaS, search, social networking and e-commerce. In aggregate these twenty companies generated revenues of over $1.7 trillion over the last four quarters, having grown 24% from the preceding four quarters.

“For hyperscale operators the pandemic proved to be more of a stimulus to growth rather than a barrier. Over the last four quarters we continued to see extremely strong growth in revenue, capex and data center spending,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “It is interesting to compare their fortunes with other types of major service provider around the world. As hyperscale capex levels keep on setting new records, it is in stark contrast with telcos whose capex has essentially been totally flat for five years now, mirroring their inability to grow overall revenues. Given the ongoing growth in service revenues for hyperscalers and the ever-increasing need for a larger global data center footprint, we are forecasting continued double-digit growth in hyperscale capex for several years to come.”