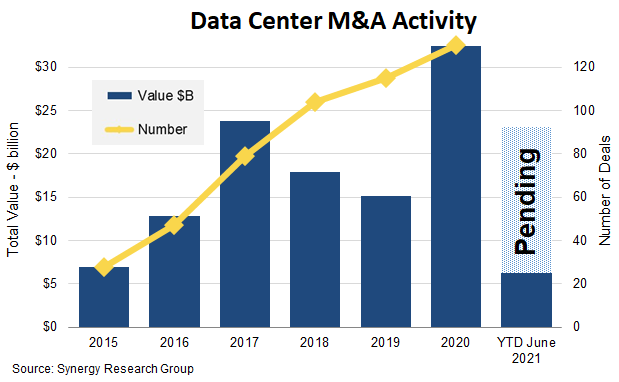

Less than six months into the year and $6.3 billion of deals have already closed, with the $10 billion QTS acquisition now taking the value of agreed deals that are pending closure up to $16.8 billion. Given the substantial number of possible deals that are in the pipeline and the regular flow of transactions that happen with little advance public notice, 2021 is shaping up to match the record-breaking M&A activity levels that were seen in 2020.

In the biggest deal ever seen in the data center world, QTS has agreed to be acquired by Blackstone Infrastructure Partners and other Blackstone entities for $10 billion. The deal includes a 40-day “go-shop” period that means it is possible an alternative buyer may come in with a bigger bid. The high valuation was driven by QTS having a large data center footprint, a revenue growth rate that is well above the industry average, and a strong presence in each of the top six US metro markets. Prior to this announcement, the biggest data center M&A deals were Digital Realty’s $8.4 billion acquisition of Interxion, Digital Realty’s $7.6 billion acquisition of DuPont Fabros, and the acquisition of Global Switch by the Jiangsu Shagang Group of China, which was eventually valued at over $8 billion in transactions that were spread over three years. Other multi-billion acquisitions have been carried out by Equinix, Cyxterra and EQT. Other notable companies who have been serial acquirers include Colony, CyrusOne, GDS, Digital Bridge/DataBank, Iron Mountain, NTT, GI Partners, Carter Validus and Keppel. In addition to the QTS acquisition, Synergy has data on five other pending deals that are valued at over $500 million plus a substantial number of smaller transactions.

“Given the explosion in the amount of data that is being generated and has to be processed, along with the ongoing boom in both enterprise and cloud markets, it is little surprise that data centers have been such a hot ticket in the M&A arena,” said John Dinsdale, a Chief Analyst at Synergy Research Group. “The data center and colocation market has been constantly evolving over the years and this will continue. The almost inexhaustible demand for data center capacity has led to a drive to find new sources of capital funding and there continues to be a long list of willing investors.”