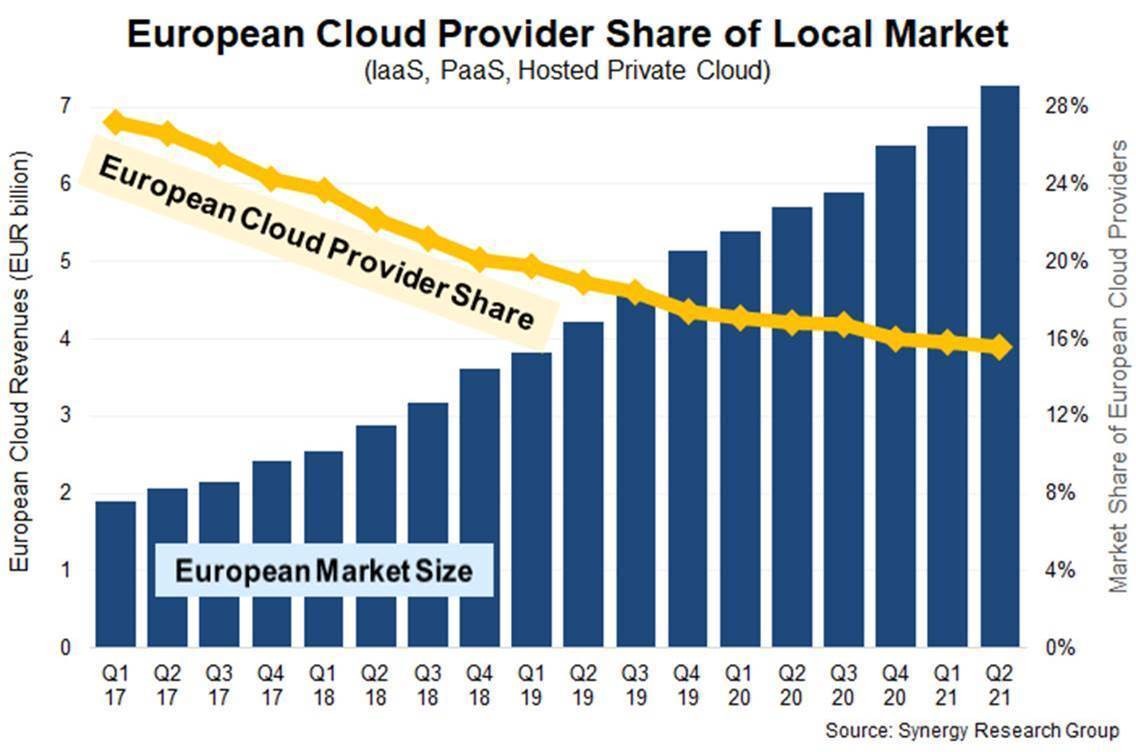

Over that same period European service providers have more than doubled their cloud revenues, but their market share has declined from 27% to well under 16% as their growth rate lagged well behind the overall cloud market growth. The main beneficiaries of the market growth have been Amazon, Microsoft and Google. These three leading global cloud providers now account for 69% of the regional market and their share continues to steadily rise. Among the European cloud providers, Deutsche Telekom is the leader accounting for 2% of the European market, followed by OVHcloud, SAP, Orange and a long list of national and regional players. The balance of the European market is accounted for by smaller US and Asian cloud providers, who are steadily losing share.

Over the last four quarters European cloud infrastructure service revenues (including IaaS, PaaS and hosted private cloud services) totaled over EUR 26 billion, up 27% from the preceding four quarters. IaaS and PaaS services account for over 80% of the market and they are also growing more rapidly than the smaller hosted or managed private cloud segment. Some of the highest growth is seen in PaaS with database, IoT and analytics services.

"European cloud providers could be quietly satisfied that they have more than doubled their revenues in a four-year period. While they have missed out on the higher-growth opportunities afforded by mainstream public cloud services, some have carved out sustainable positions for themselves as national champions or strong niche players," said John Dinsdale, a Chief Analyst at Synergy Research Group. "It is almost impossible to imagine the current market dynamics changing much in the next five years. This is a game of scale and the big three US cloud providers have ploughed over EUR 14 billion into European capex in just the last four quarters, much of this spent on a continued drive to upgrade and expand their regional network of hyperscale data centers. While Amazon and Microsoft will not be losing any sleep worrying about their future prospects, the European cloud providers can still continue to grow steadily. The key for them is to stay focused on use cases that have stricter data sovereignty and privacy requirements and on customer segments that require a strong local support network."