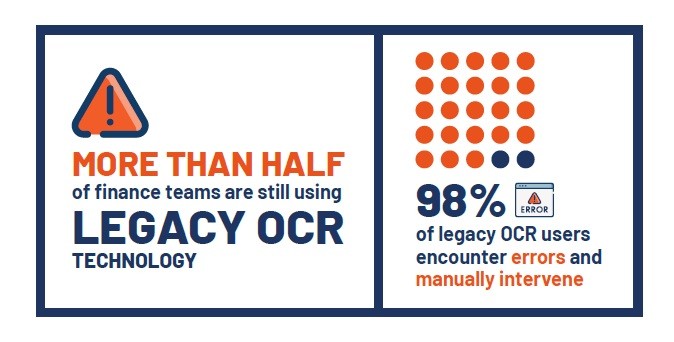

A new survey exploring the challenges and experiences of finance departments in British businesses has been unveiled, with findings revealing legacy technology is having a detrimental effect on productivity and accuracy. More than half of respondents stated they are still using legacy OCR technology, and of those, a huge 98% admit this results in errors or requires manual intervention.

Commissioned by Open ECX, a leader in financial process automation software, the survey of 810 managers working in finance departments in companies with 250+ employees, found that while 14% of those using legacy OCR technology state it is rare for it to produce errors or require manual intervention, a substantial 84% admit it happens most or some of the time.

For what is often considered the engine room of most organisations, such inaccuracies within the finance department could not only present a major risk to the business but also have a negative impact on the productivity levels of the finance teams who must then painstakingly work to resolve the errors.

Nathan Ollier, CEO at Open ECX, commented: “At a time when businesses and finance teams are under huge pressure to keep costs down, further compounded by the recently announced employer tax and page increases, it is alarming to see how widespread the use of legacy OCR technology is, and worryingly, the negative effect it is having on both productivity and accuracy within finance departments.

“It is clear that many finance teams are struggling with time consuming, manual processes resulting from outdated and complex technologies; the knock-on effect is unmotivated staff and disgruntled suppliers who are being forced to deal with these queries and errors, and ultimately, growth and productivity being held back.”

The research also revealed that over two-thirds (78%) of respondents are having to intervene in between 21% and 80% of their supplier invoice processing, and nearly one third (31%) are manually intervening in the majority (60%+) of their supplier invoices. Only 13% can claim they have to manually intervene in less than 20% of their supplier invoice processing.

Additionally, over half (54%) say their supplier statement reconciliation takes more than one working week (at least 6 days), and one in ten (11%) say it takes two-three weeks (11-15 working days).

“The level of manual intervention required in the finance and Accounts Payable (AP) function raises major concerns around the significant time being wasted on administrative jobs that could and should be tech-driven,” said Nathan.

“Automation has the potential to completely transform the finance and AP function, and as such, must become a priority for businesses if they are to capitalise on the core skills of these teams. Only then can they ensure they are delivering value and cost efficiencies for the business, rather than being burdened by lengthy and needlessly complex administrative processes.”

Indeed, automation ranked highest when respondents were asked what best described the top priorities for the AP function in 2025, with 46% stating their priority was to fully automate their invoice receipting process, requiring little or no manual intervention. This concurs with the finding that one third say their AP processes are around 41-60% automated, meaning the other half must be manual.

Interestingly, the survey also highlighted a lack of budget was the number one barrier that could stop or limit success in achieving their priorities, with 59% identifying this as their main obstacle. Budget also governed the next barriers identified by respondents, with technology (48%), time (48%) and skills (43%) all dependent on sufficient budgets.

Nathan concluded: “While budget constraints are likely to determine the level of investment in automation, as we head into 2025, businesses can ill afford to ignore the potential risks associated with legacy technologies. Even where some processes are partially automated, this is still likely to result in a lot of time being wasted on manual processes, keeping teams from higher-value tasks that could be driving more productivity and profit.

“Finance and AP teams want technologies that can automate supplier invoice processing, that can quickly and accurately reconcile statements, and that can empower them to focus on the areas of the job that delivers real and tangible value. Yes, this is an investment, but one that will drive long-term, positive change. Put simply, can businesses afford not to update their technologies and systems?”